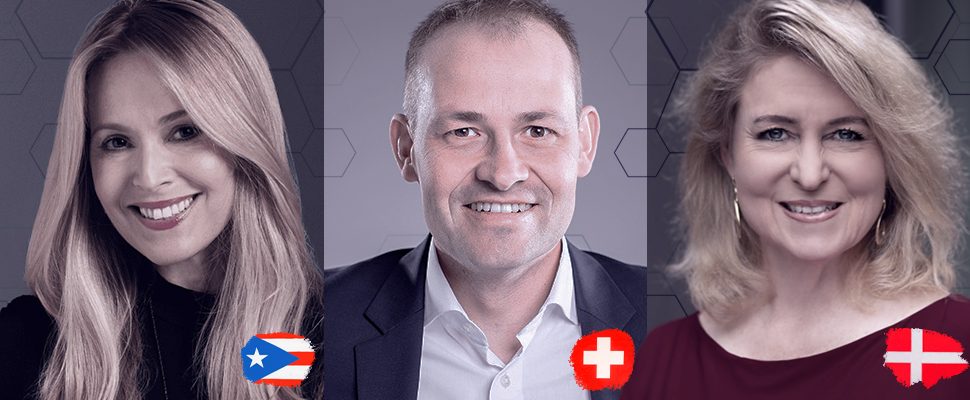

In a year marked by uncertainty and tighter capital flows, the competition to attract life sciences investment has never been fiercer. Global hubs are not just showcasing infrastructure or talent – they’re fighting for the soul, and pockets, of the industry’s future. We spoke to the CEOs of regional investment and development agencies from Puerto Rico, Switzerland’s Basel region, and the Danish-Swedish Medicon Valley. Each laid out what makes their territory not just ready for investment, but essential to advancing innovation.

Puerto Rico: A Strategic Launchpad for Global Biopharma

Both established industry players like Johnson & Johnson and Medtronic, and emerging companies have been flocking to the US territory, drawn to a large degree by its strategic location at the crossroads of the Americas. Supported by a robust logistical infrastructure that encompasses three international air trans-shipment hubs, 11 seaports, and 11 airports, including San Juan International Airport, which is IATA CEIV certified for pharmaceutical handling, the island territory facilitates efficient distribution of goods across North, South, and Central America.

These strengths, as well as its business-friendly tax policies and skilled workforce, have established Puerto Rico as a significant biopharma hub. Historically known as manufacturing centre, with its vibrant and expanding industry ecosystem, the territory is continuing to evolve. “Puerto Rico continues to be a global leader in pharmaceutical manufacturing and biosciences. However, the story has grown more dynamic in recent years,” says Ella Wogen-Nieves, CEO of Invest Puerto Rico, the island’s economic development organization. “The island now provides a unique ecosystem where global corporations and startups coexist seamlessly, supported by cutting-edge talent, state-of-the-art logistics, and a strong emphasis on R&D.”

Wogen-Nieves points out that the territory now facilitates the entire innovation pipeline—from initial research to full-scale commercialization. “Pharmaceutical and medical device companies increasingly embed R&D into their operations, using pilot plants and research facilities to develop and test products locally before entering the market. This integration streamlines the path from innovation to commercialization, positioning Puerto Rico as much more than a production hub—it is an innovation hub,” she affirms.

Historically a magnet for American companies thanks to its status as a US territory, Puerto Rico is increasingly attracting global firms. “Companies from India, Europe, Asia, and Latin America are leveraging Puerto Rico as a strategic entry point into the North American market,” asserts the head of Invest Puerto Rico.

Puerto Rico is also luring international life science start-ups to its shores. “Over the past five years, Puerto Rico’s start-up ecosystem has undergone a remarkable transformation, particularly in the life sciences sector,” says Wogen-Nieves. “This evolution has been fuelled by the rise of incubators, accelerators, and co-working spaces, as well as significantly increased access to venture capital.” She cites BioLeap, Puerto Rico’s first bioscience incubator.

“This dynamic environment has caught the attention of global investors, who see Puerto Rico as a fertile ground for innovation, particularly in cutting-edge fields like biotechnology and personalized medicine,” Wogan-Nieves continues. “The island’s growing startup ecosystem builds on its established strengths in pharmaceuticals, medical devices, and technology, blending entrepreneurial innovation with a legacy of industrial expertise.”

Basel: Talent, Capital, and Swiss Precision with Deep VC Roots

Another top destination for life science investments is Switzerland’s Basel region. With over 800 life sciences companies doing business in the area and employing over 33,000 highly skilled workers, Basel has become one of Switzerland’s leading biopharma hubs. Home to global giants like Novartis and Roche, Basel also has its share of both home-grown and international biotech start-ups.

Beyond Switzerland’s competitive tax rates and flexible labour markets, factors that continue to attract investment to Switzerland, the Basel area offers a solid life sciences ecosystem with a strong academic and research landscape, which includes University of Basel, ETH Zurich’s Department of Biosystems Science and Engineering, and the Friedrich Miescher Institute for Biomedical Research. For Christof Kloepper, CEO of Basel Area Business & Innovation, an organization that promotes the region, this is just as important. “Companies no longer just look for favourable economic conditions; they seek a robust ecosystem that fosters collaboration and growth. They want to be part of a community where they are not isolated, but rather surrounded by a network of talent and research institutions.”

The Basel area ticks all of these boxes, making it a leading hub for biopharma in Switzerland. “While other regions, like Zurich, excel in fields such as engineering and drone development, Basel’s strength lies in its life sciences ecosystem, which is unmatched in scale and depth,” says Kloepper.

Talent availability is another of the region’s attributes, in Kloepper’s view. “When companies bring in employees from abroad, particularly from the US, these individuals want to know that there will be future opportunities for them in the area. This security, knowing there are other companies within the region to turn to, makes the Basel area highly attractive.” Additionally, Basel benefits from being situated in a tri-national region, where the labour markets of France, Germany, and Switzerland overlap, creating a broader pool of talent.

“Switzerland is also highly attractive to international talent. The country’s favourable immigration policies for skilled workers, along with its high quality of life, competitive wages, and excellent educational options, including English-speaking schools, make it an appealing destination,” Kloepper confirms

Apart from the global pharma giants that have set up shop in Basel, the area has a particularly vibrant start-up scene, that attracts both local and international innovators. “The Basel area offers precisely what these companies [start-ups from abroad] need to scale, providing access to not only scientific expertise but also commercial and drug development talent, which is critical for success.”

Venture capital is yet another compelling ingredient in the mix. ”The region has strong access to venture capital, with many local and international investors operating in the region. This makes it easier for start-ups to secure funding,” Kloepper avers. The area’s life science companies, in fact, secured over USD 550 million in venture capital and private equity and USD 1.6 billion in public market financings in 2021 alone.

Medicon Valley: A Danish-Swedish Engine of Life Science Innovation

Medicon Valley, straddling eastern Denmark and southern Sweden, is a vibrant life sciences cluster with a large talent pool and top life science universities and research infrastructure. The region employs over 85,000 people in the life science industry and 14,600 university life science researchers and is home to 350+ biotech, medtech and pharma companies boasting local R&D. As well as its global pharma stalwarts, Ferring, McNeil, Novo Nordisk, Lundbeck and LEO Pharma, Medicon Valley’s unique appeal has made it an attractive destination for start-ups.

A defining feature and one of Medicon Valley’s key features is cross-border collaboration, taking advantage of its strategic position between two European countries known for their innovative spirit. “This cross-border collaboration is especially rare and valuable. The region top universities, research institutions, and highly specialized hospitals and a broad spectrum of private life sciences companies, all of which are crucial in order to build an attractive ecosystem. Of course, Novo Nordisk is a leading player in the field, but the region also boasts of many medium and smaller but innovative companies,” says Anette Steenberg, CEO of Medicon Valley Alliance, the organization that promotes the region.

Medicon Valley Alliance looks specifically to exploit cross-border synergies. “We are regional and international, and everything we do is Danish-Swedish and public-private in nature. This model of collaboration—between academia, industry, and public institutions—is fundamental to our success in life sciences,” Steenberg asserts. “Ultimately, our ambition is to build targeted areas of global excellence, rooted in cross-border collaboration and public-private partnership.”

Another unique feature of Medicon Valley is its focus on specific areas such as fertility. “This is where our region has a real opportunity to lead. We began by identifying academic excellence in fertility science on both sides of the Øresund, in Denmark and Sweden. From there, we built on this strength. Today, we have a long-running project called ReproUnion, a Danish-Swedish collaboration in reproductive medicine. It has helped position Medicon Valley as a globally recognised hub in fertility research,” says Steenberg.

This leadership has drawn global attention. “Thanks to the excellence built in this field, we are now attracting major international conferences, such as ESHRE, which has brought around 10,000 participants here on multiple occasions,” says Steenberg. “There is growing interest, particularly from Asian countries like Japan, South Korea, and China, which are grappling with demographic challenges and are eager to learn from what we’ve developed here.”

Women’s health has also become a strategic focus. “It is vital to clarify that we define this not just as female-specific conditions like endometriosis or menopause, but as all diseases affecting women—including cardiovascular disease, mental health, and autoimmune diseases,” she emphasises. In 2023, Medicon Valley Alliance launched an Innovation Panel and forged a partnership with Ferring to accelerate progress in this field, including supporting early-stage start-ups focused on women’s health. Furthermore, there are 12 active research programs dedicated to breast cancer.

Another emerging strength for the region is in the microbiome space, which is quickly gaining momentum. “We believe this holds great promise, given the scientific and commercial capabilities on both sides of the strait. We aim to be first movers in areas like this,” says Steenberg.

The region’s momentum is also reflected in its financial performance. In 2023 alone, Medicon Valley recorded 28 financing deals totalling USD 2.6 billion, with partnership deals signed by companies in the region reaching USD 9.7 billion. These figures underscore not only the region’s innovation capacity but its growing significance on the global life sciences investment map.